Something awesome is happening!

Ang MUTUAL FUNDS ay pinagsama-samang fund o pondo, na inilalagay o ini-invest sa Stock Market o Philippine Stock Exchange, sa government bonds, at iba pang market funds.

Isang rin itong paraan para mapalaki at mapalago ang ating pinaghihirapan na pera.

Tinatawag din itong makabagong paraan ng pag-iipon.

PAANO NGA BA MAG-INVEST SA STOCK MARKET?

DIRECT STOCK INVESTING

Kapag Direct Stock investing, ikaw ang Fund Manager at ikaw ang mag dedecide kung anong company ang bibilhin mo.

Halimbawa, si PLDT 3,000 per share ngayon at ang minimum board lot nya ay 5 shares, so 5 x 3,000 is 15,000 pesos. Para makapag-invest ka sa PLDT ang need mo ay 15k.

Now halimbawang bumagsak ang market at nag-withdraw/nagbenta ka ng shares lugi kana kasi isang company lang ang nabili mo, take note 15k isang company lang.

At para maging succesful ang pag-iinvest Directly sa Stock Market kailangan mo ng tatlong bagay:

a.) Time

b.) Knowledge/Technical Analysis

c.) Big Capital

INDIRECT STOCK INVESTING

.Sa Indirect stock investing naman ang tawag ay Mutual Funds, hindi ikaw ang magdedecide dito kung saan mag iinvest na company. May Professional Fund Managers na magma-manage ng pera natin.

Example, ikaw may 5,000 pesos, ako may 100,000 pesos at yung friend mo may 1 milyon. Yung 5k, 100k at 1M pagsasamahin yan ng Fund Manager at ibibili ng maraming companies, minimum of 10 BIG Companies dahil malaki ang budget natin. Dun yan ilalagay ng Fund Manager na sa tingin nya ay matatag na company.

Let's say ang mga company ay SMDC, AyalaLand, DMCI, VistaLand, Globe, Meralco, Jollibee, GMA, ABS-CBN, PLDT. assuming na yan yung 10 BIG Companies. Let's say bumagsak si PLDT, ABS-CBN at MERALC0. Kunwari yung tatlo na yan ay nalugi, pero yung 7 na natirang company ay kumita. Still, kumita kapa rin. Take note 5k lang ang budget mo nakabili ng 10 companies versus sa 15k na direct investing pero 1 company lang nabili.

BOTTOM LINE:

Kung ikaw ay may Time, Knowledge about Technical Analysis at may malaking Capital, mag-invest ka sa direct Stock Market. Pero kung ikaw ay bago pa lamang, wala pang idea talaga at di kalakihan ang capital, I suggest mag Mutual Funds ka muna and then kapag alam mo na ang pasikot-sikot ng Stock Market that's a time na magsimulang mag-direct stock investing. Sa Indirect Stock investing naman, maaari kang magsimula for as low as 1, 000 pesos only.

INTRODUCING

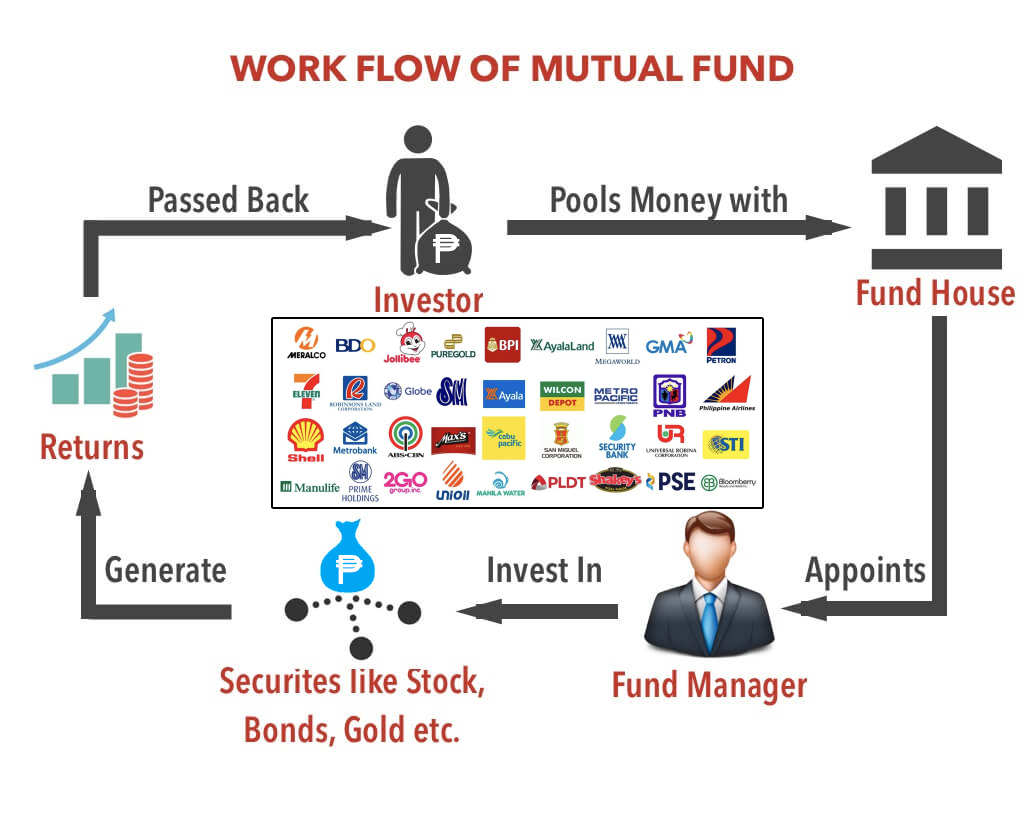

WORK FLOW OF MUTUAL FUND

Ang MUTUAL FUNDS ay pinagsama-samang fund o pondo, na inilalagay o ini-invest sa Stock Market o Philippine Stock Exchange, sa government bonds, at iba pang market funds.

Isang rin itong paraan para mapalaki at mapalago ang ating pinaghihirapan na pera.

Tinatawag din itong makabagong paraan ng pag-iipon.

Mutual Fund is the best way to start investing in Stock Market because:

1. It is Professionally Managed

Kung nagsisimula ka pa lamang sa pag-iinvest much better na ipaubaya muna natin ito sa mga experts (Professional Fund Managers) at kapag familiar kana sa sistema ng Stock Market dun kana mag-start ng direct investing. Kumbaga sa pampasaherong jeep, kung hindi ka pa marunong mag-drive, ipaubaya mo muna ito sa driver. Sumakay ka lang muna at makakarating ka ng safe sa pupuntahan mo.

2. It is Very Liquid

Meaning anytime pwede mong i-withdraw, some Mutual Fund companies may mga charges pero kapag nalagpasan mo na ang holding period wala na itong charges. Parang bank lang din ang MF, ang pinagkaiba lang ay sa Bank madali mo siyang makuha sa thru ATM, unlike sa MF 3-7 days pa para ma-withdraw ang pera. So, wag na wag mong ilalagay lahat ng pera mo sa MF, make sure na may laman pa rin ang Savings Account in case of emergency.

3. It has a Low Minimum Investment Requirement

For as low as P1,000 - P5,000 you can open ang account in MF (some MF companies requires P10,000 – P100,000 to open an account). Ma-swerte tayo sa panahon ngayon dahil mababa nalang ang investment requirement, unlike dati na kailangan mo talaga maglabas ng hundred thousands para makapag-open ng account sa MF. Sa panahon ngayon khit minimum wage earner, magbabalot, janitor, construction worker, etc. pwede na maging INVESTOR. At kung mag-iinvest ka monthly pwede ka mag-top up basta minimum of P1,000.

4. It is Diversified

Yung P5,000 mo na yun ay mabibili agad ng minimum 10 BIG Companies (Blue Chip Companies) yan yung mga companies na matatagal na talaga. Hindi ka basta basta malulugi sa MF dahil DIVERSIFIED na siya, dahil khit malugi man ang 3 companies let’s say si PLDT, Meralco, BDO. Yung remaining 7 companies naman ay kumita, still kumita ka pa rin.

5. It is Very Transparent

May matatanggap kang SOA (Statement of Account) quarterly, dun nakalagay kung ilang shares na meron ka at magkano na total ng kinita ng pera mo. Since Shareholder ka ng MF Company, may karapatan kang umattend ng mga Shareholder’s Meeting, dun ididiscuss kung saan ba ininvest ang pera natin, ano ba naging performance this past few months or year. Sa Mutual Funds you’re a Shareholder or Stockholder of the Company.

6. The Gains are Tax-Exempt

Kapag bumili tayo ng isang bagay merong tinatawag na sales tax/value added tax. Kapag nag-withdraw tayo sa savings account natin merong tinatawag na withholding tax at kahit na mamatay tayo meron pa ring tinatawag na estate tax. Pero sa Mutual Funds, walang tax. Kung ang money mo sa MF ay P100,000 at nagwithdraw ka, buong-buo walang labis, walang kulang P100,000 pesos pa rin yan.

7. Zero Load

Ibig sabihin nito ay walang kaltas ang pera mo. For example nag-open ka ng MF Account mo with 5,000 minimum initial investment. Kung Zero Load ang Mutual Funds mo buong buo yang 5,000 mo ay ibibili ng shares. Pero kung hindi yan Zero Load may ibinabawas na around 3% sa pera mo and every time na magdadagdag ka ng investment mo may 3% pa rin na ibabawas dito.

WHAT IS THE NAVPS?

NAVPS/ NAVPU (net asset value per share/ unit) is the value of one share/ unit of a mutual fund. This is computed by dividing net assets by the number of shares/ units held by an investor. Fund managers buy and sell shares/ units in a mutual fund according to the NAVPS/ NAVPU, which changes every business day depending on the market value of the assets of the fund.

If the NAVPS/ NAVPU of the mutual fund you are invested in increases or appreciates, you can sell your mutual fund shares/ units for a profit. In the same way, if the NAVPS/ NAVPU of the mutual fund you are invested in decreases or depreciates, you may realize a loss if you redeem.

PAANO KUMIKITA ANG PERA SA MUTUAL FUND?

Formula:

(Current NAVPS x total No.of Shares)

Sa pag iinvest sa mutual fund Hindi palakihan ng halaga ng nainvest mo ang labanan. Kundi, paramihan ng shares na nabili at patagalan ng taon.

For example:

From 2001-2007, invested Php 3,000 monthly

Total amount invested: Php 250,000

No of shares accumulated: 49,014.33

Net Asset Value per Share: Php 11.2818 (2007)

Staying period: 9 years 2007-2016

Total Amount invested with gains/loss: Php 1,672,109.17

No of shares: 49,014.33

NAVPS as of (05-04-2016): 34.1147

GAINS: 1,420.109.17

Kaya pag down ang market wag mo withdrawhin

Umabot na ng 43.+ yung NAVPS nito last 2018

Pero last March 12, 2020 lang, yung NAVPS ay 28.5919 dahil bagsak ang market because of COVID-19.

Upang mas maunawaan mo kung bakit, panoorin mo ang video.

Like any other investment instrument, mutual funds are best held long-term especially for mutual funds that have investment objectives of capital growth such as equity funds.

How to Start MUTUAL FUND Investments?

There are 2 options to start your Mutual Fund investment:

FIRST OPTION: Pwede kang mag-open ng Mutual Fund account diretso sa mga Mutual Fund Companies. Maghanap lang ng agent or ng CIS (Certified Investment Solicitor) sa kanilang office upang ma-assist ka nila.

Here are the list of TOP Mutual Fund Companies in the Philippines that I know:

- Philam Asset Management, Inc. 12th Floor, Ayala Life-FGU Center, Ayala Avenue, Makati City

- Sun Life Asset Management Company, Inc. Rizal Dr, Taguig, Metro Manila

- ATR Asset Management, Inc. 17th Flr., Tower One & Exchange Plaza, Ayala Triangle, Ayala Avenue 1226, Makati City

- Philequity Management, Inc. Suite 2004-A, East Tower, Philippines Stock Exchange Centre, Exchange Road, Ortigas Center 1605, Pasig City

- Soldivo Funds under Rampver Financials Unit 2202, 22nd Floor, Antel Corporate Center, Valero, 3 Access Rd, Makati City

- First Metro Investment Corporation GT Tower, Ayala Ave, Makati, Metro Manila

Maaari kang magpunta sa offices nila upang makapag-open ng MF account. PERO, may tinatawag silang Entry Fee or Sales Load na ibinabawas sa tuwing tayo ay mag-iinvest, usually nasa 3.5% ang charges depende sa mutual fund company.

For example ay nag-invest ka ng P100,000 sa isang MF company. Automatic yan ay may ibabawas na 3.5% sa perang ininvest mo. P100,000 x 3.5% = P3,500 Ibig sabihin may ibabawas na P3,500 sa perang ininvest, instead na buong P100,000 ang perang naibili mo ng shares ay nabawasan pa at naging P96,500. At sa tuwing dadagdagan mo pa ang investment mo ay may ibabawas pa rin na Sales Load.

SECOND OPTION: Pwede kang mag-open ng Mutual Fund account through IMG (International Marketing Group). Kaya kung isa kang member ng IMG ay sulit na sulit ay iyong membership dahil isa sa mga benefits ng member ay ZERO LOAD sa Mutual Fund Investments. Ibig sabihin kung halimbawang P100,000 ang na-invest mo ay buong buo yan walang bawas mabibili lahat ng shares.